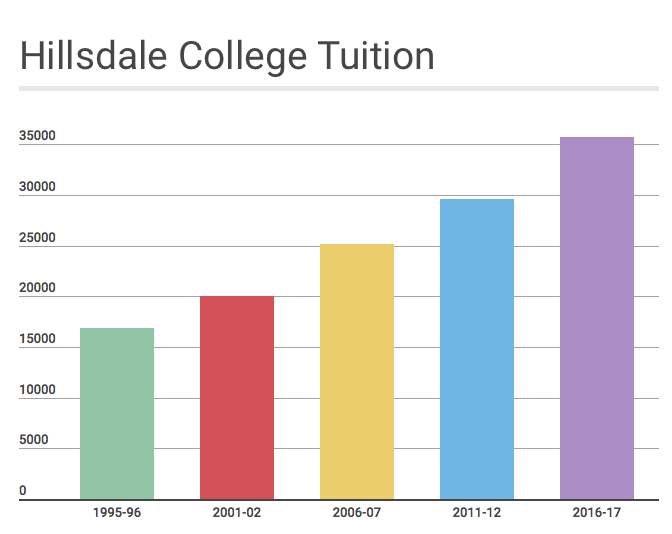

Hillsdale College increased its total costs to $35,722 for the 2016-2017 academic year.

Over the last decade, HIllsdale’s costs have risen approximately 3-4 percent annually. Despite the trend, Hillsdale has kept its tuition costs significantly lower than its competitors, even though it refuses to accept federal funds. And current students expressed that the overall value and distinctiveness of a Hillsdale degree outweighed the increases in tuition costs.

“The major takeaways are Hillsdale’s increase in tuition and fees is slightly below average,” Director of Institutional Research George Allen said.

Compared to similarly sized liberal arts colleges in the Midwest, Hillsdale’s tuition grew by 20 percent, but the average was 22 percent. The college had the lowest cost of tuition and fees of its 31 peer schools. In fact, Hillsdale’s current tuition and fees is less than 30 of those institutions’ costs in the 2011-2012 school year.

And during the economic recession, in 2008 and 2009, the college froze tuition costs to protect families.

Overall, universities rely on tuition to cover their costs of operation. Tuition costs account for a large portion of a university’s revenue, so to finance new projects and keep up with costs of a growing labor force, infrastructure, and maintenance fees, universities often increase tuition to meet these financial demands. As most colleges take a portion of federal and state taxpayer money, universities tend to increase tuition, relative to the amount of funds they receive from the government.

“It is true that at Hillsdale the cost of tuition is very low relative to the quality of education, facilities, and programs available to students,” Chief Administrative Officer Rich Péwé said. “We do work very hard here to keep costs down, but the product is outstanding.”

The reason Hillsdale College is able to maintain such low tuition rates, Péwé said, is because the college makes strategic investment decisions that outsmart the competition.

“We think better,” Péwé said. “Other colleges will hire a bunch of adjuncts to teach new programs. We hire full-time faculty. We operate the facilities and our administrative functions as cost effectively as possible, so we can maximize our return on all our investments.”

Aside from inflation, wage increases as well as a growing number of faculty are two primary reasons the college experiences tuition increases as time passes.

“We have grown the faculty, 45 in the last 15 years,” Péwé said. “We have shifted resources from other areas, building in efficiencies — to do more with less — and help cover the cost of more full-time and better faculty to teach. Also, we want to keep the student faculty ratio at no less than 10-1, so when our enrollment increases, we have to balance this with new faculty.”

Hillsdale College is also able to drive down tuition costs by diversifying its revenue sources, so it is less dependent on tuition costs. Housing costs, meal plans, and revenue from the bookstore are additional revenue streams that aid in balancing the overall costs. Many departments like marketing and fundraising are self-funded, so they do not contribute to the overall costs of running the college.

As Hillsdale is privately funded, most construction projects the college takes on are covered by endowments from private sources, meaning they do not impact the colleges financial burden whatsoever. This activity rarely occurs at other colleges, Péwé said.

Aside from having to cover its costs of operations completely independent from the state, Hillsdale must raise its own funds to pay for loan and scholarship programs.

“If we raise tuition, we just have to go out and raise that much more scholarship money to cover that extra cost,” Péwé said. “Other colleges might just increase their enrollment to get the extra revenue from taxpayers. When we increase enrollment, we end up having to raise even more money from our friends to help pay for scholarships.”

Rich Moeggenberg, financial aid director, said the cost increases of 3-4 percent are “very manageable.”

“If you look at state colleges, that increase is low,” Moeggenberg said. “I think the highest increase within that ten-year period was less than 5 percent.”

In addition, there are several scholarship opportunities for students that are not available to incoming freshmen. To keep up with rising tuition costs, students can earn additional scholarships or reduce their total bill by moving off campus or getting a part-time job.

Students have the opportunity to interview for GOAL Program leadership positions and Dow Journalism Program, George Washington Fellowship, and Winston Churchill Fellowship memberships, as they continue their education, Moeggenberg said.

“There are a cohort of about 15 or more internship positions which have scholarships or monies attached to them,” Moeggenberg said. “As Dr. Arnn said, we like to have students help us run the place.”

And even loans, which help to continue a relationship between the college and its students, return to the school, and their interest go toward loans for the next generation of Hillsdalians.

“When students repay their loans, that the payments they make on that loan goes directly into a scholarship fund who is loaned to another student who pursuing the same kind of education that they had.” Moegenburg said “And when students call about their loans, they aren’t speaking with Citibank to Discover Bank, or someplace in China, they are talking to Alice, whom they’ve known for six years, so it is relational.”

And a similar relationship forms with donors, as well, for many students have the opportunity to meet the people sponsoring their education at Hillsdale and creates a culture of gratitude.

“It’s not just taxpayers money,” Moeggenberg said. “It’s ‘Mr. Johnson,’ who is getting his checkbook out every year to personally fund their education… It creates a different environment. It puts a smile on peoples faces.”

Tuition costs, however, are a large concern for those applying and attending college, students said.

“Price was a huge factor in selecting a college,” freshman Kathryn Bassette said. “I ended up taking a gap year, because I’m paying for my own education and needed to work to pay for my first year of school. In coming to college, I had to wrestle with the question: ‘Is higher education worth the cost?’ and I had to consider what kind of education best suits my needs.”

Bassette said a Hillsdale degree was worth it.

“We all know the liberal arts education — specifically Hillsdale’s — is so unique,” Bassette said. “It’s not just learning as a means to an end, but it is enjoying the process of learning itself. I view it as an investment.”

The “uniqueness” of the education offered at Hillsdale is a powerful advantage, according to the admissions office.

“When I began working at admissions in 2008, there were a lot of concerns about money and the usefulness of a liberal arts education,” said Jenny Brewer, director of field recruitment for admissions.

Attitudes surrounding the value of a liberal arts education have shifted in the college’s favor, as more studies show how critical thinking and having a well-rounded education improves individuals’ careers, Brewer said.

“I also think that the overall atmosphere in higher education has become more friendly to liberal arts degrees, not necessarily our philosophy, but the kind of education which we provide,” she said. “What we often tell families is that if it’s a numbers game alone, Hillsdale College probably cannot win. But when you consider the sort of education that Hillsdale provides — that we do believe that there is truth and that it does not change — the whole purpose of education changes.”