The U.S. economy still appears healthy, according to professors in Hillsdale College’s economics department, despite the Dow Jones industrial average experiencing its largest single-day drop ever on Monday.

“The underlying market economy clearly has not changed much over the past few days,” said Gary Wolfram, economics department chairman. “The economy is actually doing well.”

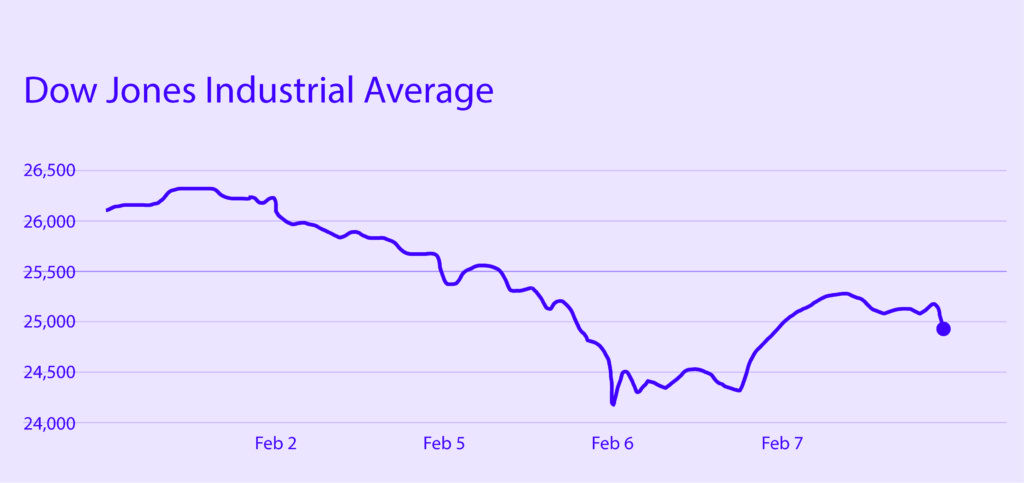

The stock market index fell nearly 1,600 points at its low and closed 1,175 lower than its opening value, a 4.6 percent drop. That was the Dow’s largest intraday decline since August 2011. After Monday, the Dow has experienced volatile swings.

Hillsdale economics professors, however, noted that the stock market is only one indicator of the economy and that other signs appear to be trending well with recent reports of wages increasing, a steady unemployment rate at 4.1 percent, and new tax and regulatory cuts.

“It might update my feelings on the year a little,” Associate Professor of Economics Michael Clark said. “It’s one indicator, yes, so we update — marginally. Do I like seeing my net worth drop 4 percent in one day? No, but I don’t see it as symptomatic of a functional problem of current investments and market activities.”

Janet Yellen told CBS News in her final interview as the Federal Reserve chairwoman in an article published Sunday that the stock market and other assets were running high.

“Now, is that a bubble or is [that] too high?” she said on Friday, her last day at the Fed. “It’s very hard to tell. But it is a source of some concern that asset valuations are so high.”

Wolfram said her statement might have signaled a rush of selling. It also may have hinted that interest rates could soon rise again, encouraging people to look into more secure investments such as bonds.

Associate Professor of Economics Charles Steele noted that low interest rates on bonds have driven many investors to the stock market, perhaps leading to the highs the Dow has seen. It set a record high of 26,616.71 on Jan. 26.

“I think there has been something of a bubble,” Steele said. “The stock market, if you want your money to grow, has been one of the few places to put your money.”

Between Feb. 1 and Tuesday’s opening, however, the Dow dropped 7.7 percent. Wolfram said changes within 10 percent typically represent a correction.

“I think what you’re seeing is a normal pullback driven by traders, but it’s been orderly,” Wolfram said. “We have not done that for a very long time.”

Nonetheless, over one year, the Dow was still up 21 percent after tanking. Wolfram noted the typical expected rate of return over years on the stock market is 8 to 9 percent.

“The price to earnings ratio was a little high, and now it’s a little low,” Wolfram said. “That tells you this thing is going to bottom out.”

That would likely spur more buyers, he said. For now, though, the market is in flux, Wolfram said.

“People are going to be scared,” he said. “You’re going to have some volatility over the next, probably, couple of weeks.”