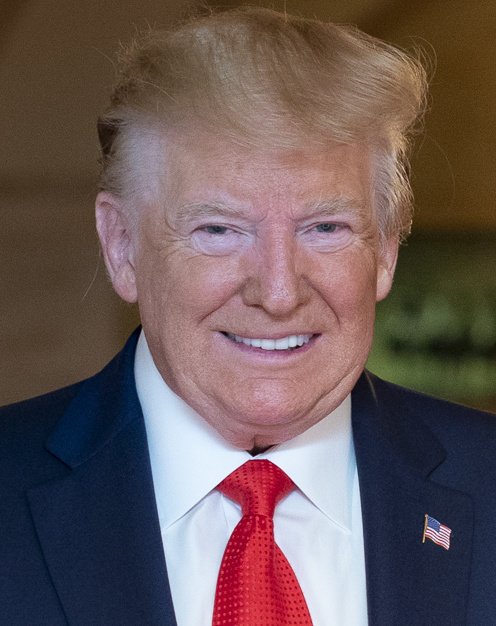

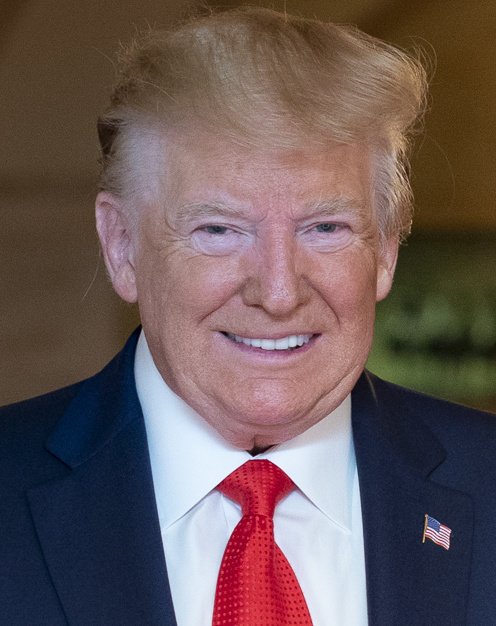

President Donald Trump proposed his budget for the 2021 fiscal year last week. It has been received with a chorus of boos from the progressive left for its spending cuts, domestic programs, and proposed funding of the border wall.

The Democratic Party does not like Trump’s budget. They should not be alone, however, in their disappointment with the proposal. Republicans and conservatives must also appraise the Trump budget for what it is: a mixed bag at best, and a massive disappointment at worst.

Politicians talk about balancing the budget the same way students discuss homework on a Friday night. They’ll get it done quickly, so they can go out for a drink later.

The United States has run a budget deficit that has racked up more than $22 trillion in debt, thanks in large part to the unwillingness of bureaucrats to address entitlement spending. In 2017, 24% of the federal budget was devoted to Social Security with $945 billion shelled out to senior citizens. In the same budget, nearly $600 trillion was allocated for Medicare. Economists forecast that the cost of both programs will only escalate further as more of the baby-boom generation enter retirement.

It is both inexcusable and a national embarrassment that our public servants have refused to keep the costs of both programs in check, and thereby passing on an enormous I.O.U. to the next generation of Americans.

When Trump announced his presidential bid in 2016, many wondered if he could finally change the culture of waste in Washington, D.C. There was hope he would seriously tackle our nation’s budget problem. At his campaign announcement in 2015, Trump pledged not only to reduce the deficit, but actually begin paying down the national debt. In December of that year, Trump boldly proposed a “budget freeze” to halt the growth of all discretionary expenditures. It appeared that maybe Trump would be the one to finally break through and restore sanity to America’s finances.

And then Trump got to talking about entitlement reform.

“I’m not going to cut Social Security like every other Republican, and I’m not going to cut Medicare or Medicaid,” Trump swore in the primaries, effectively derailing any hope of a fiscally responsible administration.

Since Trump took office, the annual deficit has increased from $665 billion in 2017 to $1.1 trillion this year. Dramatic increases in defense spending and the 2017 tax bill added to the growing cost of entitlement programs. The national debt has increased by nearly $4 trillion in Trump’s first term alone. For perspective, the previous Republican president George W. Bush needed eight years with two wars and an economic collapse to rack up the same amount of debt.

Many in the Trump White House have argued the increase in the deficit was an unfortunate side effect of the needed tax relief to grow our economy. To his credit, Donald Trump has enjoyed the best economy in a quarter-century for his entire first term. Wages are growing across all demographics, unemployment is at an all-time low, and workforce participation is on the rise. The Trump economy is booming. And his tax reform bill deserves some credit.

But now that we are more than two years removed from the passage of the tax cuts and the economy is in great shape, it is time for Trump to get serious about the deficit.

Indeed, never has there been a better time than now for Washington D.C. to finally tackle entitlement reform and overhaul Social Security and Medicare. For the first time in a generation, our employment numbers and GDP growth are strong enough that steep cuts to federal spending would not risk a recession.

In the 1990s, the United States enjoyed a similar economic boom with the rapid growth of technology in the workplace. The explosion, caused by the rise of the internet, led to a prolonged era of peacetime growth. In the midst of this, Washington addressed the budget deficit. President Bill Clinton kicked off his second term by signing into law the bipartisan Balanced Budget Act of 1997 that set America on course to running a surplus within the next five years. Both parties agreed that a booming economy was an ideal time for the United States to make necessary spending cuts.

We again are in the midst of an economic renaissance in the United States. Yet even with the most ideal of conditions to make difficult decisions, President Trump has mostly passed the buck on entitlement reform and tackling the deficit. To his credit, he does propose some reforms to Medicare and Medicaid. The White House budget would tighten eligibility for Medicaid and alter prescription drug provisions in Medicare. However, those savings average out to only about $42.2 billion per year over the next ten years. For perspective, that will only cut the annual deficit by 3% of its current level. Social Security remains an unaddressed ticking time bomb whose trust fund is estimated to run out by 2034.

The path towards a balanced budget begins with reforming Social Security. To do so, the Trump Administration should back three common sense proposals. First, raise the retirement age from 65 to 69 by the year 2030. When Social Security was first created in 1935, life expectancy for men was 59 years, and for women it was 63. Today, the average American lives until they’re 78 years old.

Raising the retirement age would reduce the deficit by $100 billion by the end of the decade.

Second, Trump must embrace a new cost of living index for calculating Social Security benefits. Adopting “Chained CPI”, a proposal set forward fifteen years ago by economists, would save $340 billion by 2030.

Finally, Trump should propose mean-testing benefits for high-income seniors. It makes little sense that a multimillionaire elderly couple receives the same amount in Social Security benefits as a widow in a working class neighborhood. These three proposals would cumulatively reduce the deficit by over half of a trillion dollars and save Social Security for future generations; more importantly reining in the long-term growth of non-discretionary spending.

If Donald Trump’s desire is to score quick and easy political points with a safe budget, he should stick with his current proposal. But if he wishes to leave a legacy of leadership and oversee a presidency that positively impacted the lives of the American people, he must address entitlement spending.

Matt Fisher is a senior studying political economy.