In the 1980s and ’90s, Will Carleton loans were a regular part of conversation — like picking up a drop/add card or hearing the chimes of the clock tower. Now, though the business office still offers these loans, only about two or three students use them each month, because many students don’t know about them, student loan staff said.

The Will Carleton loan serves as an emergency cash fund. Students bring their ID card down to the business office and sign a contract, and, for a $2 lender’s fee, they can have up to $50 for 30 days — no interest. Money returned after the 30 days adds a $5 late fee and a hold on the account until it is paid.

“If something comes up unexpectedly and [students] need money, that’s basically what it was set up for,” Senior Counselor and Student Loan Manager Jan Seegart said. “It’s there for the students, that’s why we have it.”

The loan is popularly used to buy books, especially at the beginning of the semester before outside loans and scholarships have come in. In some infrequent and atypical cases, students may apply for a slightly larger loan, but they must state their reasons and the loan must be approved by Financial Aid Director and Student Records Richard Moeggenberg.

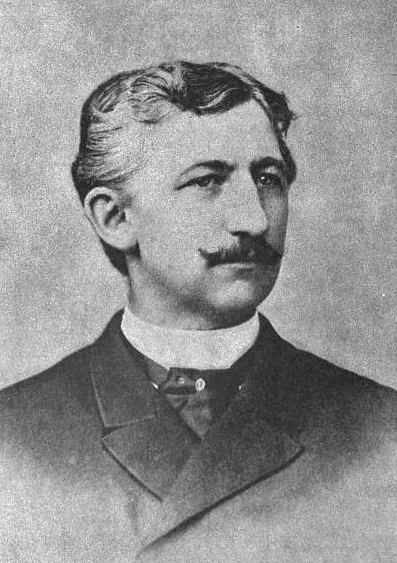

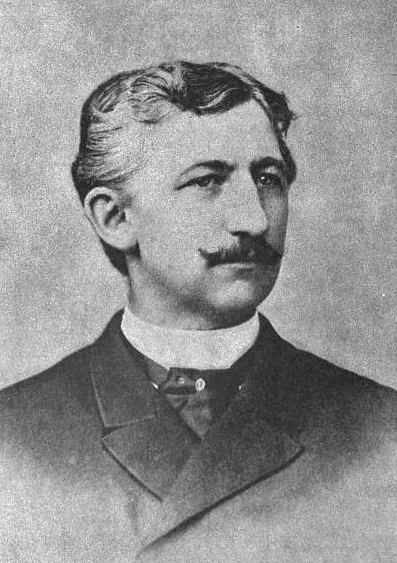

Established almost 100 years ago in 1923 by the Will Carleton Memorial Association, the fund originally contained about $3,500. According to a 1997 Collegian article, Carleton, an 1896 graduate and famous poet, initiated the fund and “was one of his special interests until he died” because “he knew from personal experience how difficult it was to get an education when funds were scarce.”

Now, it is used primarily for other emergencies rather than education. Senior Frank Bruno said he used the loan once while waiting for a reimbursement for a club.

“I was in a pinch. Last year, I was the president of Young Americans for Freedom and one week I had to pay for a whole bunch of supplies all out of pocket. I was really low on funds, and this got me through the period until reimbursement,” Bruno said. “I would use it again, I definitely think this is an asset that should be used.”